Life Insurance or Term Insurance - Which is Better? Know the difference & compare the benefits

The insurance world has become a jungle for many, so finding the right one that best suits your needs and helps you feel secure is the key to achieving your financial dream.

image for illustrative purpose

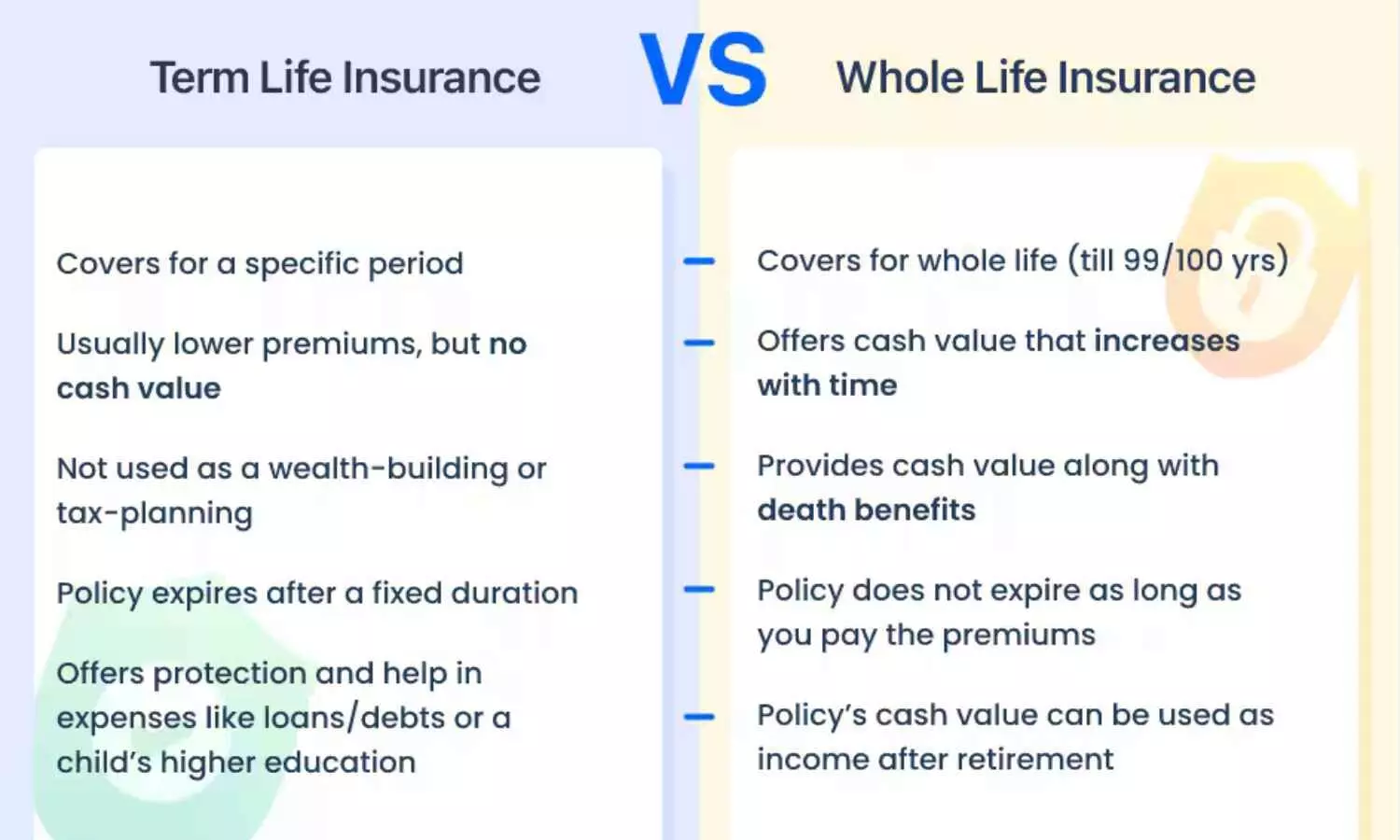

From relying on physical forms and manual processes to becoming fully digital, the insurance world has undergone significant changes. Today, we have so many options, including life insurance, term insurance, health insurance, auto insurance and so on. However, among all these choices, life insurance and term insurance gained significant attention. If we talk about them, life insurance covers you and your family in case of your death, whereas term insurance provides coverage during the selected period. But with all this information, the question arises: which one is right? This is where understanding the key differences and benefits of the two is like finding the right direction in the investment club. So, let's delve in and make sure you have the right insurance for your peace of mind!

Term Insurance vs Life Insurance: Difference

Benefits of Life insurance

Buying a life insurance policy offers financial security and peace of mind. Furthermore, it also allows you to invest your premium in various other options based on your risk appetite. Last but not least, it provides double tax savings benefits, offering tax deductions under Section 80C of the ITA, 1961.

Benefits of Term insurance

Term insurance plans offer coverage until the age of 99, depending on the policy term. This plan also benefits customers by providing high-value life insurance. Furthermore, the plan also gives lump sum money to consumers for accidental death and terminal illness. Moreover, term insurance also offers tax benefits on premiums paid u/s 80C&D of the ITA.

Thus, the onus is on you to choose the insurance that best meets your needs!